Moving into your first apartment can be an exciting and liberating experience. However, it can also be a daunting task, especially when it comes to managing your finances. Creating a budget and sticking to it is crucial to ensure that you can comfortably afford your new living situation.

To get your first apartment, you need to figure out how much you’ll spend, calculate how much you make, gauge how much to save, then create and stick to a budget.

Whether you are moving out of your parents’ house or transitioning from a college dorm, this guide will equip you with the knowledge and tools you need to start your independent living journey on the right financial footing.

Understand the Importance of Budgeting for Your First Apartment

Moving into your first apartment is a big step towards independence and adulthood. However, it also comes with a lot of financial responsibility.

It is essential to have a clear understanding of your financial situation and how much you can afford to spend on your monthly expenses. Budgeting is crucial when it comes to managing your money and keeping your expenses under control.

Creating a budget should be one of the first steps you take when planning to move into your first apartment. A budget will help you track your income and expenses and ensure you are not overspending, which is especially important for people who are just starting out and may not have a lot of extra money to spare.

One of the most significant benefits of budgeting is that you’ll have a clear idea of how much money you have to spend each month, which can help you prioritize your expenses.

By keeping a close eye on your finances, you are less likely to overspend or use credit cards to pay for things you cannot afford. This can help you avoid high-interest rates, late fees, and other charges that can quickly add up and put you in debt.

Ensuring you stay within your budget can also help reduce financial stress by giving you a sense of control over your finances. In conclusion, budgeting is a crucial part of managing your finances, especially when you are moving into your first apartment.

By creating a budget, you can have a clear understanding of your monthly income and expenses, prioritize your spending, and save money for the future. It can also help you avoid debt and financial stress, allowing you to focus on enjoying your new apartment and all the independence and freedom that comes with it.

Benefits of planning and saving ahead of time

Planning and saving ahead of time can provide numerous benefits when it comes to renting an apartment. The first and most obvious benefit is financial security. Having a solid plan in place and the necessary funds saved up in advance can help eliminate the stress and worry of potentially not being able to pay rent or unexpected expenses that may arise.

Furthermore, planning ahead allows individuals to shop around and explore different housing options, ensuring they find the apartment that best fits their needs and budget. Additionally, some apartment complexes require a security deposit or other upfront costs, which can be easily covered through careful planning and saving.

Ultimately, planning ahead can result in a more comfortable and stress-free living situation, allowing individuals to enjoy their new home without worrying about the financial burden of rent or other expenses.

Calculate How Much You Need to Save

Calculating how much you need to save for your first apartment can seem daunting. We’ll go over one-time costs associated with moving into an apartment as well as monthly expenses to help you figure out the best plan for you.

Identifying initial move-in costs

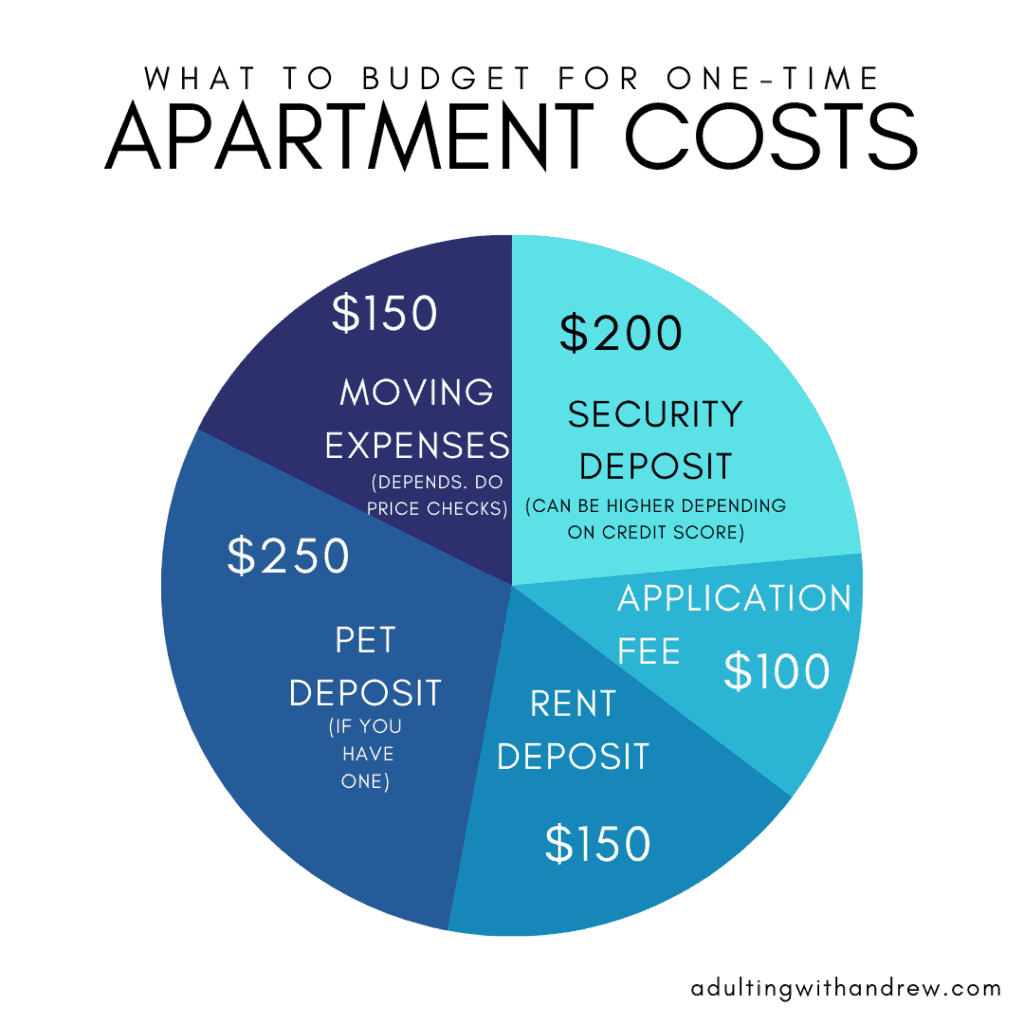

When considering moving to a new apartment, there are several initial costs that you as a prospective tenant need to be prepared for.

These costs can vary depending on various factors such as the location, size, and age of the apartment. Some of the initial move-in costs that need to be considered include security deposits, application fees, first and last month’s rent, pet deposits or fees, utility deposits, and moving expenses.

Fortunately, only some of these are likely to apply. I’ve only ever had to pay a security deposit and application fee to my apartment complex. Having enough money to pay for your first and last month’s rent upfront will provide you with more options and flexibility, though, so it’s not a bad idea to factor that into the savings goal that we’ll talk about later.

Security deposits are usually required upfront and can range from $200 to two months’ rent to cover any potential damages to the apartment. Application fees are usually non-refundable and cover the administrative costs of processing the application (around $100).

If you have pets, a pet deposit or fee is likely to be required. Utility deposits may also be required if the apartment does not include utilities.

Moving expenses fall outside of one-time expenses paid to the apartment, so you have more options at your disposal, such as hiring a moving company, renting a moving truck, or purchasing moving supplies. For your first move, it’s unlikely you’ll need to hire a moving company.

You may need to rent a moving truck, like from U-Haul if you don’t have a car at your disposal that can fit your furniture, which will likely run you around $100 for a crosstown move. My last rental truck was only $47 because I moved less than 10 miles away, so do your research to figure out what your price would actually be.

Estimating ongoing monthly expenses

Now that we’ve got one-time expenses covered, it’s time for recurring expenses that come with living in an apartment.

The first, and most obvious, expense to consider is rent, which can vary greatly depending on the location and size of the apartment. Here’s an article with more information on how apartment pricing works.

Utilities are another crucial expense. These include electricity, gas, water, and trash. Some of these will likely be included as a flat fee, which you can ask about as you visit apartments.

The last apartment-related expenses are renters insurance and internet.

For renters insurance, I used Lemonade, which cost me around $11 per month and was super easy to understand. I later canceled with Lemonade to bundle with my car insurance, which made the renters insurance essentially free, so check into those and other avenues to get the best deal.

I’ve always paid for internet that’s a little faster than I need to make sure I didn’t have any issues. It’s always been between $40-$50 using introductory deals. Your apartment should tell you what providers are available in their complex, but the internet providers usually know even better. I used Cox in my first apartment, and Xfinity in my second. You can fill in a potential address to see any services and offers.

Food is likely a top-three expense (rent and transportation being the others) and likely the most flexible of the major expenses. You can eat quite inexpensively at home. But you also likely enjoy going out, so that could make it a very large expense.

Transportation costs, such as gas, car insurance, parking, and public transit if you use it, should also be taken into account. If you have a car payment, you’ll need to factor that in, too.

Don’t forget about miscellaneous expenses, such as entertainment or gym memberships, should also be accounted for.

Create a Realistic Budget

When saving for an apartment, it is essential to have a realistic budget in place.

To begin creating a budget, start by analyzing your income. Look at your pay stubs or bank statements to determine how much money you have coming in each month, whether from a 9-5 job, a side hustle, or freelancing.

Using the research you’ve done on apartment prices where you’re looking coupled with the rest of the expenses we looked at earlier, you can start putting all of the pieces together to see how they line up.

That all sounds rather complicated, so where do we start?

Figuring Out Where to Start Your Rent Budget

Knowing the potential living expenses and actually seeing how they work with your income are totally different things. Here’s a 5-minute video with a resource that can flesh out your budget nicely.

As you can see, going through the conscious spending plan from Ramit Sethi is an excellent way to understand how your numbers for your apartment will fit together. It even has percentages to help you know where you should be allocating money, something I wish I’d known about far earlier. When starting out, it’s usually okay to go a bit over on fixed expenses as you’ll be able to even that out once you get more experience and increase your income.

If you think that’s great, his book, I Will Teach You to Be Rich is filled with everything you need to get your financial foundation set.

In case you didn’t watch the video, here’s a quick summary. Download the conscious spending plan, enter your income, plug in your planned expenses after moving in, and play with the rest of the numbers until you find the allocation sweet spot for your situation.

If that sounds simple, it’s because it actually is. Notice I said simple, but I didn’t say easy. You’ll likely have to sacrifice things you like to do the things you love, but that’s okay!

Budgeting for Moving Expenses

You should likely add a savings line for moving expenses into your spending plan. Figure out how much you think the move will be based on the area you’re looking to move to and the amount of stuff you have.

Then simply divide how much it’ll be by how many months away your planned move is, and put that number into the spreadsheet. Adding 10% is a good practice to cover extra hidden fees and taxes, but either way will get you a great start and a specific number that can make the whole process more tangible.

If you’re nervous about the moving process, here’s a great guide to help you when moving out for the first time.

Exploring ways to trim expenses and increase income

If you’re looking to move into an apartment but don’t have the funds to do so, there are a few things you can try to increase your income and reduce your expenses.

To start with, you can look for any unnecessary subscriptions, memberships, or services that you subscribe to and cancel them (New Year’s gym membership that you never canceled because you’ll get back one day, for instance). And as I said earlier, if you eat at home instead of going out all the time, you could save a lot of money.

You could consider taking on a side hustle, such as freelancing or driving Uber (or Uber Eats) to earn extra cash. If you’re currently employed, look into negotiating a raise or becoming eligible for bonuses.

Lastly, make sure that when you add a new large expense (like rent), to shop around for the best deals.

Tips for Sticking to Your Budget and Saving Goals

Living in an apartment can be a challenge when it comes to setting and sticking to a budget. However, with a bit of discipline and planning, it is possible to save money and reach your financial goals.

We’ll start with a few easy tips as a warm-up.

First, make your budget realistic. However much you think you’re going to spend in a month, add 10%. That’s another reason why Ramit’s conscious spending plan is so helpful and simple to use as it automatically adds a cushion to your expenses.

Avoid credit card debt! When you use a credit card, pay them off in full each month to avoid accruing debt. Otherwise, you’re dumping money into the credit card companies instead of your own bank account. If you can’t buy it yet, just wait a few weeks or months while you save, then buy it.

Tracking spending and progress regularly

One of the keys to achieving financial success on the path to getting an apartment is to track spending and progress regularly. This will allow you to celebrate your financial wins when you hit milestones on your journey.

Tracking your spending can show you where you can cut back and save money, which can be useful when you’re trying to reach a savings goal. Fortunately, you can track your spending easily in free apps like Mint and Empower (previously Personal Capital). I recently switched from Mint to Empower because Empower makes it much easier to see spending trends and gives me a good idea of my financial picture without a lot of digging.

You also don’t need to check every day. That actually works against most people who are trying to save as it scares you as you constantly watch your money fade away.

Staying accountable and motivated

When saving for an apartment, it’s essential to stay accountable and motivated on your financial journey. Picture the life you want to live, and use your money to head in that direction. Having a good perspective on money’s role will help you stay motivated.

Celebrate small financial wins like reaching a savings goal, which can boost your confidence and motivate you to keep going. This could include treating friends to a meal and telling them that you hit some financial milestones, which creates interpersonal accountability, if in a small way.

Adjusting the budget as needed

No budget is perfect or timeless, and there will always be unexpected expenses or changes that arise throughout the year. Being able to adapt and pivot accordingly is crucial to avoiding financial pitfalls and staying on track with your goals.

Be flexible with your budget, which can include cutting back on certain expenses, allocating more funds to priority areas, or even setting aside more money in case of emergencies.

It’s important to regularly review your budget (quarterly could be a good start) and make changes as necessary to ensure that your finances are in the best possible shape for the life you want to live.

Take Action and Start Planning for Your First Apartment Today

Taking action towards getting your first apartment now can save you time, money, and stress in the long run, even if you don’t want to move out in the near future.

Start by understanding the expenses you’re going to deal with then set a budget and create a savings plan. Research apartments in your desired location and make a list of must-haves and nice-to-haves. Utilize online resources like apartment finder websites and social media groups to find potential roommates or landlords.

For more info on how long the apartment-hunting process might take, check out this article.

Create a checklist of necessary items for your new place, such as furniture and kitchen supplies, and start acquiring them gradually as your budget allows. Don’t be afraid to ask for advice from friends or family who have gone through the process before.

Getting your first apartment can be daunting, but it is also incredibly empowering. So, take charge of your future and start planning today. You got this!

And if you want to know what to do after you get your apartment, this article outlines 9 things to do after you move into your new apartment.