How exactly does apartment pricing work? What are some costs you might not know about before getting your first apartment?

Apartment pricing includes a combination of recurring and one-time costs that include rent, utilities, and security deposits. Factors such as location, availability, and amenities factor into what you can expect these costs to be.

Here’s a breakdown of what factors may dictate the prices of the apartments you are looking at followed by what costs to budget for in the apartment-hunting process.

Factors that affect apartment pricing

There are a lot of factors that affect apartment pricing. Here are some of the most important and impactful ones.

Location

Location is a major factor when it comes to pricing an apartment. Apartment prices can vary greatly depending on the neighborhood, city, or even country in which you choose to live.

Those living in bustling metropolitan areas will often pay more for their apartment than those living in rural locations because of the greater access to jobs, entertainment, and cultural activities that come with living in a big city.

Additionally, factors such as commute times and proximity to amenities like grocery stores and public transportation can also affect apartment pricing.

Apartments located near parks or other desirable features can also have higher prices due to the increased desirability of these locations.

Amenities

Amenities are an important factor in determining the price of an apartment.

Apartments with more amenities tend to cost more than those with fewer amenities. “Thank you, Captain Obvious.” What can I say? It’s a gift.

Amenities can include things like a swimming pool, gym, game room, laundry facilities, a DVD library, and more. Some apartments also offer extra in-unit features such as terraces or balconies, fireplaces, walk-in closets, and heating/air conditioning.

Size and number of bedrooms/bathrooms

The size and number of bedrooms and bathrooms in an apartment have a direct impact on the cost of the space.

Square footage is expensive, not only to build but to maintain.

Each new room you’re looking to add to your apartment hunt is going to add to your expenses.

Competition in the area

Renters may find that their options are limited if there is a lot of competition for apartments in the area, as landlords will often increase prices to keep up with demand.

On the other hand, areas with less competition can offer renters more options and potentially better deals on apartments.

You can usually get a better deal depending on the month you move, as outlined in this article.

It’s also always a good idea to look into nearby neighborhoods and compare rental rates.

Calculating your total cost for an apartment (including rent and utilities)

It’s important to know how much an apartment will actually cost so that you can know how much you should budget for it. There are recurring and one-time expenses involved in getting an apartment.

Recurring expenses (utilities, deposits)

Rent

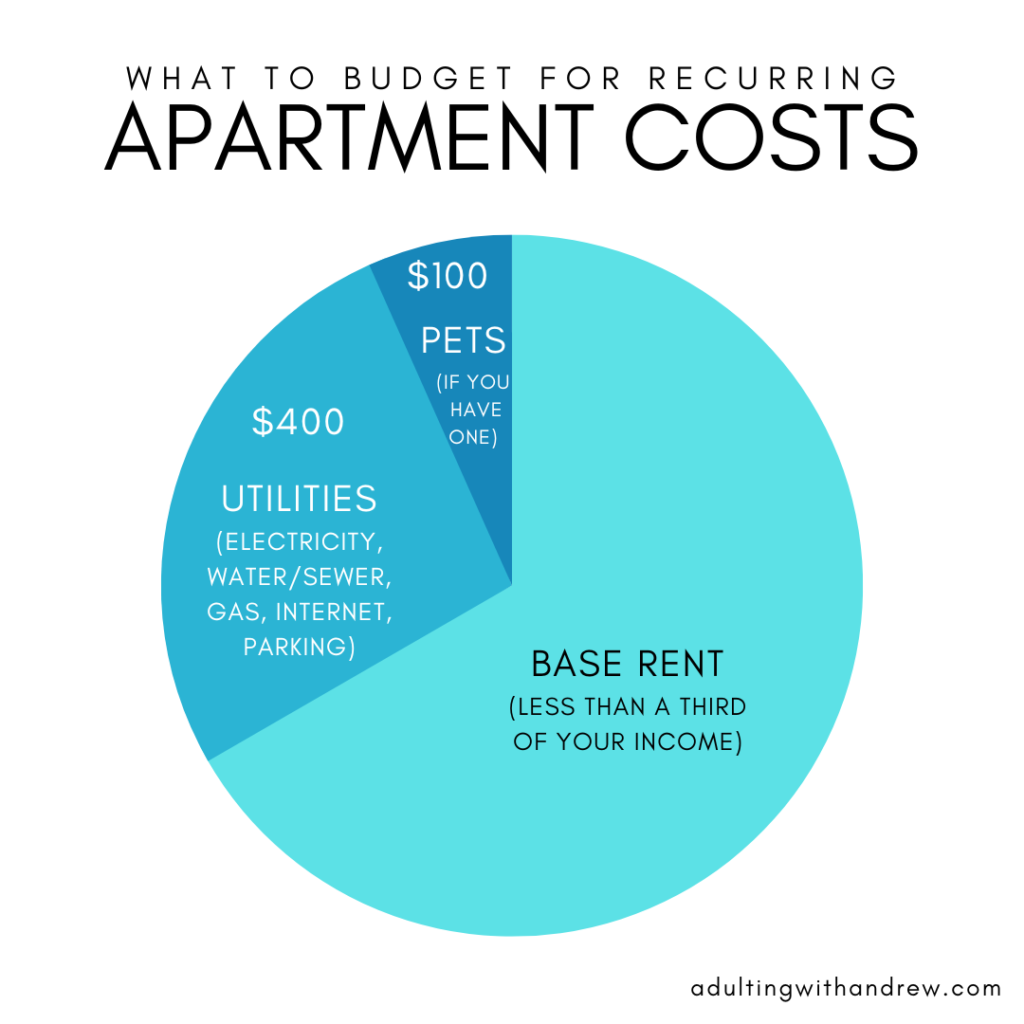

When deciding how much of your income to spend on rent, it’s best to spend less than a third of your gross income on rent.

This means that if you make $3000 per month, rent should not be more than $1000.

If you can make it less than a third by adding roommates, it can really pay off.

Utilities

Unfortunately, base rent isn’t your only recurring expense. That’s just how much living in the space is without any utility costs.

You can get a full breakdown of the average cost of utilities in this article. If you’re really not sure where to start, having $400 per month set aside to cover electricity, gas, water/sewer, and internet is a good idea. This will also depend on specific area and size of your place, but it’s not a bad starting point.

This is where having a base utility cost can really save you. I had an apartment where everything (aside from internet) was bundled for less than $100 per month.

Parking

Some complexes charge for parking and others don’t. Covered spots generally cost between $10-$25 per month, so be sure to check during your tour how the parking situation works.

Pet policies

If you have pets, pet policies can have a big impact on the pricing of an apartment.

There will likely be a non-refundable pet deposit and/or monthly pet rent.

Most apartments also have rules about what kinds and sizes of animals are allowed. Budgeting $100 per month is a good idea, though, it will likely be somewhere in the $25-$80 range.

One-time expenses

Application fee

You’ll need to pay an application fee as part of the process. This is almost always a non-refundable payment that covers some of the apartment’s administrative fees. It’s generally around $50.

Security deposit

You should also expect to pay a security deposit. This amount varies widely and can depend greatly on your credit score.

That being said, I’ve had $200 security deposit both times I’ve rented a new apartment.

Another fortunate thing about your security deposit is that if you take decent care of your apartment, you should get most of that money back when you move out.

Rent in advance

You’ll likely have to pay some rent in advance before moving in. It will likely be a full month’s rent around the time you finish the paperwork, regardless of when you move in.

This also varies, so ask the apartment complex to know their specific policy.

Moving

Moving can be a huge expense. If you just need to move across town without a lot of furniture accumulated, you can likely do so for a few hundred dollars.

But if you’re moving farther away or have more needs/stuff, it can be several thousand dollars. Sometimes it pays to pack light.

You got this!

Knowing how much an apartment is going to cost can be tricky, especially at first.

You now know to spend less than a third of your income on base rent, factor in several hundred dollars per month on other recurring expenses including utilities, and what one-time costs to look for during the application process.

Armed with this knowledge, you’re ready to look for a place of your own!